Hi guys

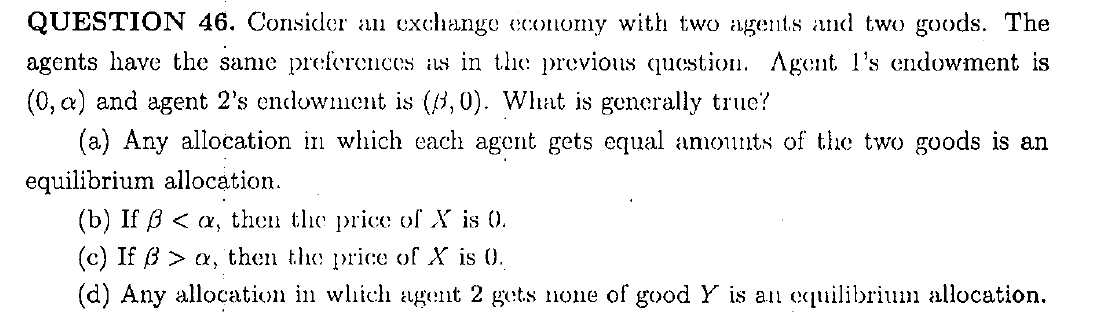

I want to confirm that what will be pareto efficient allocations if b (beta) > a (alpha).

What I have got is for the market of X to clear, price of X should be zero (which is the answer for the question). So, in that case agent 2 cannot buy anything and agent 1 will buy a units from 1, and maximizing his utility. So, pareto efficient allocation can be

Agent 1 : (a, a)

Agent 2: (b-a, 0)

Other pareto efficient allocations can be with more than a units of x with agent 1 and correspondingly less with 2 which won't change the utility.

Is this correct?