DSE Macro!

|

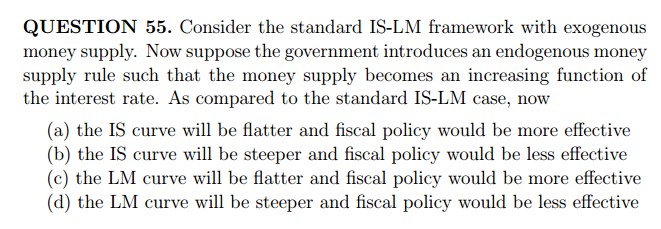

In this case slope of LM will reduce as compared with the standard LM relation ...therefore LM will be flatter nd fiscal policy will be more effective...

|

|

Vaibhav could you please explain your point .

"Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth."

|

|

You can check this point by taking usual LM at one side with exogenous money supply nd on the other side take money supply as a function of interest rate, i, i.e. M/P = ¶i where ¶ is positive constant..... Now solve for i from both the LM relation, u'll find that the slope of former eq is higher than the latter one....now graph both the eqs nd u will find when IS shifts ∆Y is more in latter LM .....

Or in other words when when G increases then Y increases now this increase in Y will result in higher demand for money nd in order to clear the asset market interest rate has to rise now consider two cases: *when money supply is exogenous then the rise in interest rate will lead to fall in investment spending I.e crowding out *when money supply is a func of interest rate then when interest rate rises then money supply will also rise nd in order to be in equilibrium in asset market this rise in supply will result in rise in money demand which will lower the rate of interest rate to some extent nd thus Investment will fall in this case also but less than the first case....therefore lesser will be the crowding out nd more effective will be the fiscal policy... |

|

In reply to this post by Arushi1

Its bettr if u start drawing diagrams for each and every question, wherever possible

this ques is very easy thru diagram and intuition...no maths requared.... ans is LM vl b flatter amd more effective fiscl policy

Akshay Jain

Masters in Economics Delhi School of Economics 2013-15 |

|

In reply to this post by Dreyfus

Vaibhav Iam getting your point , but not really clear with this. And mathematically Iam not at all able to proceed with all this.

In your logical explanation , upto less crowding out Iam clear , but then how do you decide the slope of LM here ? Akshay , it will be great to have your viewpoint as well.

"Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth."

|

|

@ anjali....for deciding the slope u hv to consider the lm relatyion in eq form....anyway As Akshay pointed out ..........draw two LM CURVES one steeper nd one flatter and along with it draw IS also.....nd mark the equilibrium Y for each LM curve.....now take fiscal exp by shifting IS to the right ....nd then find new equilibrium for both the LM .....u'll find DAT.....∆Y of flatterlLM is more than that of steeper one......

|

|

In reply to this post by Anjali

Usual LM equation: M/P = kY - hi (where M/P fixed value) but now M/P with interest rate is in a particular relationship (becomes endogenous)

so, put M/P = mi (here, m is some positive co-efficient denoting that relationship) your LM equation then becomes, => mi = kY - hi => i = kY/(m+h) clearly, k/(m+h) < k/h (thus LM slope has become flatter as a result)

“Operator! Give me the number for 911!”

|

|

I agree with akshay. Start with drawing the i and Md(money dd) graph. In standard IS-LM, we take Ms(money supply) to be a vertical line but in this question, since Ms is in increasing function of i, we take Ms to be a positively sloped curve. Now, to derive the LM curve for this situation, increase Y, (to see how the eqb i changes), so that the Md(money demand) curve shifts out, but you notice that the change in equilibrium i is lesser in the case of the positive slope Ms as compared to the vertical Ms(standard). Hence our derived LM curve is flatter compared to the standard LM curve. IS curve remains the same so you can check how the economy reacts to a fiscal policy now that you have both the standard and new LM curves. You will witness that Y changes more in the new LM when IS shifts.

|

|

Thank you guys! :)

I did start out by drawing the curves but wasn't sure of the approach. Glad we're on the same page. |

|

initially we have a vertical money supply curve parallel to y axis and thus any increase in y results in increase in interest rate because of shift of money demand curve outward. this implies an upward sloping LM curve.

now moving towards the change in policy, that makes money supply curve upward sloping and flatter, thus any increase in y now has two impacts. It shifts money demand curve outward and crosses money supply curve to a point with higher interest rate and higher money supply but in this case increase in interest rate is lower because of money supply curve. now turns to the is lm model , in lm relation after policy change increase in y increases interest rate but with a lower impact than before policy change and thus flatter LM curve. |

«

Return to General Discussions

|

1 view|%1 views

| Free forum by Nabble | Edit this page |