JNU SIS 2013

|

can anyone please explain Q4. A monopolist has constant marginal costs at Re 1 per unit, and zero fixed costs. It faces the demand curve a) 20 |

|

Administrator

|

Its simple, profits (as a function of q) for the above demand function can be written as:

profits(q) ={ 100 - q if q >= 5, { 0 - q if q < 5 Clearly, the profit maximizing choice is q = 5 and therefore, p = 20. |

|

In reply to this post by Kajol

Hi Kajol!

Here, you can't essentially use the MC and elasticity formula, since it comes to zero. I simply used the options to check for which of the output, the profit is maximum. Profit= P*Q-(MC*Q) , with option d, q=10, and consequently p=100/q=10 10*10-(1*10)=90 With option a, q=20 and price=100/20=5 100-(20*1)=80 With c, q=1/99, this would make p>20, and thereby quantity zero, which contradicts. With option b, p=20, q=5 20*5-(5*1)=95 Hence The answer is b. |

|

In reply to this post by Amit Goyal

Thank you Sir, this is a fool proof way of looking at such problems :)

|

|

Yes it's clear now. Thanks a lot Sir:) On May 9, 2016 3:38 PM, "SM [via Discussion forum]" <[hidden email]> wrote:

Thank you Sir, this is a fool proof way of looking at such problems :) |

|

In reply to this post by SM

And thank you SM :) On May 9, 2016 3:52 PM, "Kajol Dawar" <[hidden email]> wrote:

|

|

In reply to this post by SM

Can anyone please explain these questions?

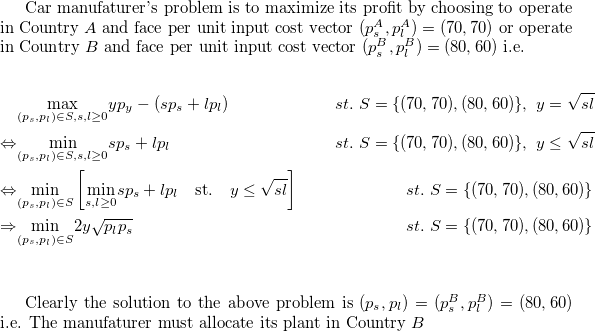

Q3. A car manufacturing company wants to decide where to locate a new plant. The only inputs used in cars are steel and labour, and the production function is f (S, L) = (S^1/2)(L^1/2), where S is tons of steel and L is units of labour. The company can locate its plant either in country A or in country B. In country A, steel costs Rs 70 a ton and labour costs Rs 70 per unit. In country B, steel costs Rs 80 per ton and labour costs Rs 60 per unit. In which of the two countries should the company locate its new plant? (a) Country A (b) Country B (c) It is indifferent between country A and country B (d) The information given is not sufficient to determine Q21. If the home marginal propensity to consume exportable is greater than the elasticity of the foreigner's offer curve, then in the absence of inferior goods, a tariff (a) lowers the domestic prices of importable (b) increases the domestic prices of importable (c) No impact on domestic prices (d) Cannot say Q24. There are two countries A and B with their currencies denoted as 'A$' and B$' respectively. Their nominal exchange rates in terms of US Dollars (USD) are as follows : A$ 50 = USD 1; B$ 1 = USD 1.5 The nominal prices of petrol per litre in the two countries are A$ 75 per litre and B$ 1 per litre respectively. It is reported that in purchasing power parity (PPP) terms, petrol prices are three times higher in country A than in country B. Compare a resident of country A earning AS 50,000 per month with a resident of country B earning B$ 2,000 per month. In PPP terms (a) resident of country A is better off than resident of country B (b) resident of country A is at par with resident of country B (c) resident of country A is worse off than resident of country B (d) Cannot say |

«

Return to General Discussions

|

1 view|%1 views

| Free forum by Nabble | Edit this page |